Bitcoin: A Modern-Day Tally Stick, Lincoln Greenback, or Alberta Prosperity Certificate

Except, it's backed by energy

In the ever-evolving world of finance and economics, Bitcoin has emerged as a revolutionary digital currency, sparking debates and discussions worldwide. To understand its significance, it's essential to draw parallels with historical forms of currency and economic strategies that have shaped the financial landscape. This blog explores how Bitcoin shares similarities with the tally sticks of medieval England, the Lincoln greenbacks of the American Civil War, and the Alberta Prosperity Certificates introduced by Premier William Aberhart during the Great Depression. These three historical events show that governments do not have to borrow money in an attempt to avoid calamity. Particularly, we will delve into how Bitcoin, like these historical examples, uses a currency ledger to provide liquidity in times of economic distress without the need for bankers to borrow the government some money.

The Currency Ledger Concept

At the core of Bitcoin and its historical counterparts lies the concept of the currency ledger. A currency ledger is a record-keeping system that tracks the issuance, transfer, and ownership of currency. This system ensures transparency, trust, and accountability, which are crucial for any functioning economy. Let’s first understand how this concept was implemented in historical contexts before examining Bitcoin's innovative approach.

Tally Sticks: Medieval England’s Ledger System

Tally sticks were an ingenious method of record-keeping and currency used in medieval England. These wooden sticks were marked with notches to denote amounts of money and split into two parts: one for the debtor and one for the creditor. The notches represented the amount owed, and the split stick ensured that both parties held a matching record, making counterfeiting extremely difficult.

Tally sticks served multiple purposes:

Recording Transactions: They kept a reliable record of debts and payments.

Preventing Fraud: The physical nature of the split sticks provided a secure method to prevent tampering.

Facilitating Trade: They were used as a medium of exchange, enabling trade even when coinage was scarce.

Lincoln Greenbacks: A Civil War Innovation

During the American Civil War, President Abraham Lincoln faced a severe shortage of gold and silver to finance the war effort. In response, the government issued "greenbacks," a form of paper currency not backed by gold but by the government's credit. The greenbacks served as a ledger-based system, recording the government’s promise to pay the bearer a certain amount of money.

Key aspects of greenbacks included:

Liquidity Provision: They provided much-needed liquidity in a time of financial crisis.

Government Trust: Their value was derived from the trust in the government’s ability to repay its debts.

Economic Stability: By injecting liquidity, greenbacks helped stabilize the economy during wartime.

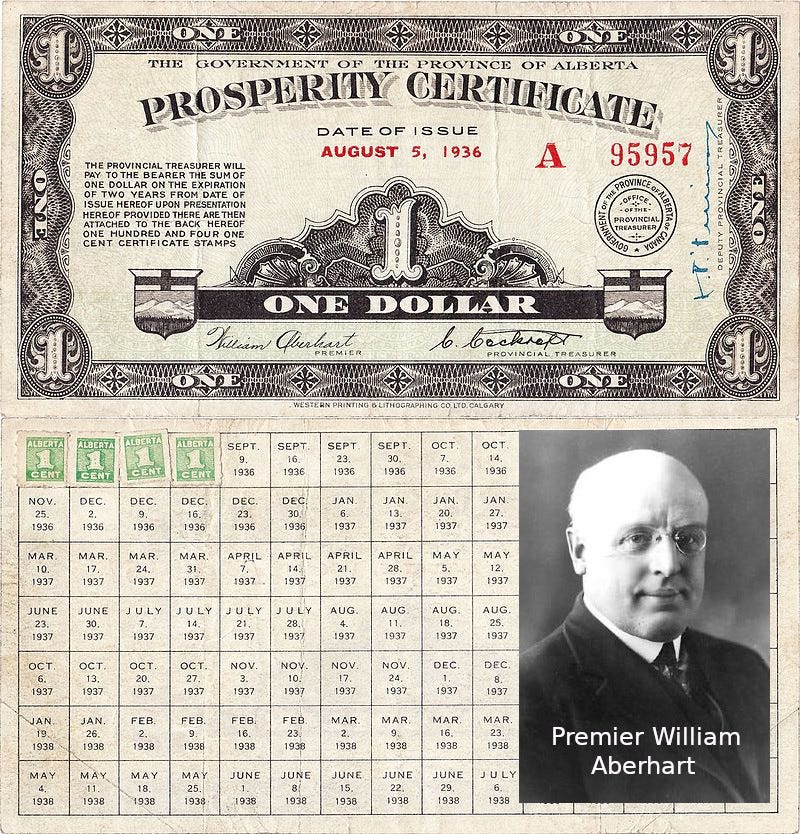

Alberta Prosperity Certificates: A Depression-Era Solution

Premier William Aberhart introduced Alberta Prosperity Certificates in 1936 to combat the economic hardships of the Great Depression. These certificates were issued by the provincial government and could be used to buy goods and services, or settle debts within Alberta. Similar to greenbacks, they were not backed by traditional reserves, such as gold that had been monetized beyond what should have been allowed, but by the government’s commitment to accept them for tax payments.

The Prosperity Certificates had several significant features:

Enhancing Liquidity: They injected liquidity into a struggling economy, enabling transactions and stimulating economic activity.

Government Backing: They could be issued for relief, for

road work, and other government expenditures.

Encouraging Spending: The certificates included a mechanism to encourage their use, helping to circulate money in the local economy.

This approach is similar to modern fiat currencies like the Canadian dollar, which is also not backed by gold. Both the Alberta Prosperity Certificates and the Canadian dollar derive their value from the trust in the government's ability to manage the economy rather than from a physical commodity. The transition away from the gold standard, where currencies were loosely linked to a specific amount of gold, began in the early 20th century and was largely completed by August 15, 1971. Today, the value of the Canadian dollar is determined by various factors, including economic indicators, market demand and supply, interest rates, money printing and overall confidence in the Canadian economy and our Prime Minister.

At 1.226 trillion debt we're in an economic death-spiral. We need to cut up Trudeau's credit cards. He's out of control. Or we need to encourage him to debase the Canadian dollar more and store our wealth in bitcoin. Why tax the Canadian people when you can just print money and the Canadian people will say “At least I can still buy a cup of coffee with my devalued Canadian dollar.”

Bitcoin: The Modern Digital Ledger

Bitcoin, introduced in 2009 by an anonymous entity known as Satoshi Nakamoto, represents the evolution of the currency ledger into the digital age. Bitcoin’s ledger is changed via proof of electricity (the blockchain miners) and is a decentralized, immutable record of all transactions that have ever occurred on the network. Bitcoin uses sats for liquidity. 100 million sats equals 1 bitcoin. Right now, 1 Canadian dollar can buy you 1048 sats. Or a better way of expressing value is how much your sats can buy. My neighbor sells me pasture raised eggs for 5,000 sats. I sell my 1 lb of saskatoons for 6,600 sats or 1 lb of hamburger for 5,000 sats. I have been paying my neighbor 50,000 sats for a shoulder message. Bitcoin for me and certain parts of the world works like a digital ledger for goods and services, but we are still early only 400 million people use bitcoin and most of them use bitcoin as a store of value and not a means of exchange. Most Canadians are so naive they think our Canadian Prime Minister taxes and spends rather than prints and spends and they think storing value in Canadian dollars is a good idea. The Canadian dollar is backed by nothing!

Decentralization and Trust

Unlike traditional currencies, Bitcoin operates on a decentralized network of computers (nodes). This decentralization ensures that no single entity controls the currency, enhancing security and trust among users.

Immutable Ledger: Once a transaction is recorded on the blockchain, it cannot be altered, ensuring a transparent and tamper-proof record.

Peer-to-Peer Transactions: Bitcoin enables direct transactions between parties without intermediaries, reducing transaction fees and increasing efficiency.

Consensus Mechanism: The network uses a consensus mechanism (Proof of Work) to validate transactions, ensuring the integrity of the ledger.

Represents Value Without Resorting to Money Printing: Bitcoin's value is derived from its scarcity and the trust in its decentralized system, without the need for traditional money printing by central authorities.

Liquidity in Times of Crisis

Bitcoin's role as a sound currency provides the functions of tally sticks, greenbacks, and Prosperity Certificates. During times of economic uncertainty, Bitcoin offers an alternative means of liquidity that is independent of traditional financial systems. At least bitcoin represents truth just like the Talley stick, greenback and the prosperity certificate. The leaders in those time periods didn’t try to pretend something they made for free was based on gold, but realize it was just a ledger. I view that currency should not be debased because it needs to uphold truth.

Only bitcoin can not be alter via greed or altruistic intentions.Borderless Transactions: Bitcoin can be used globally, providing liquidity across borders without the need for currency conversion.

Hedge Against Inflation: In countries facing hyperinflation, Bitcoin is often seen as a store of value, preserving wealth when local currencies lose value.

Accessibility: With internet access, individuals can participate in the Bitcoin economy, bypassing traditional banking systems that may be inaccessible or unreliable.

Security and Transparency

Bitcoin’s blockchain ledger provides unparalleled security and transparency:

Cryptographic Security: Transactions are secured by cryptographic algorithms, making fraud and counterfeiting nearly impossible.

Public Ledger: Anyone can view the blockchain, ensuring transparency and accountability in transactions.

Decentralized Control: No central authority can manipulate the currency, reducing the risk of systemic failures and corruption.

During times of crisis’s, liquidity allows services and products to exchange hands. The more people there are who will buy your product or service the better off we all are. If we increase the 21 million bitcoin supply (which we won’t do) we are saying the code is not right. Canada removed 10 billion of liquidity in 3 months this year. Finally, in Bitcoin, we have a system where emotions don’t play a part in the communication of the value of products. 400 million people enjoy using a currency that cannot be manipulated via governments “good/bad intentions”.

Think for yourself and question everything, my fellow pre/post bitcoin people! And be careful you don’t get scammed by the governments telling you they have something real to give you when the truth is it is only printed money. At least King Henry I, Abraham Lincoln and William Aberhart told the truth about this.

Do you think Canada leads the way in totalitarian efforts to control it's populace like RFK Jr.?

The greenback period lasted until 1879 when the US returned to the gold standard. Then this happened: (Rothbard)

"The figures tell a remarkable story. Both consumer prices and nominal wages fell by about 30% during the last decade of the greenbacks. But from 1879-1889 [on gold standard], while prices kept falling, wages rose 23%. So real wages, after taking inflation-or the lack of it-into effect, soared."